Vietnam securities sector driving the new IPO wave

- duyenthu.vietdata

- Oct 29, 2025

- 2 min read

Vietnam's stock market is ready to welcome a new wave of corporate initial public offerings (IPOs).

According to the latest report by VNDirect released on October 21, Vietnam's IPO market is on the verge of a new growth cycle after years of stagnation since 2018. Historical data shows that the Vietnamese IPO market has experienced two waves in past IPOs with different driving forces.

The 2007 IPO wave was a peak in terms of the number of listed enterprises, with 63 companies conducting IPOs, totalling $2.55 billion, mainly driven by the privatisation and divestment process of state-owned enterprises (SOEs). This was the early development period of Vietnam's stock market, where securities market policies and corporate governance standards were still rudimentary, with the focus being mainly on converting ownership from state-owned to joint-stock companies. Typical IPO deals in this phase included Vietcombank (VCB), Vietnam National Insurance Corporation (BVH), Phu My Fertilizer (DPM), and PetroVietnam Finance Joint Stock Corporation (PVI).

The second IPO wave, from 2017-2018, is considered the golden era of IPOs in Vietnam, and featured an explosion of deals in scale and number, driven by continued divestment activities at large SOEs such as PetroVietnam Power Corporation (POW), Vietnam Oil Corporation (OIL), and Binh Son Refining and Petrochemical JSC (BSR), plus the strong rise of leading private conglomerates like Vinhomes, VRE, Techcombank and HDBank.

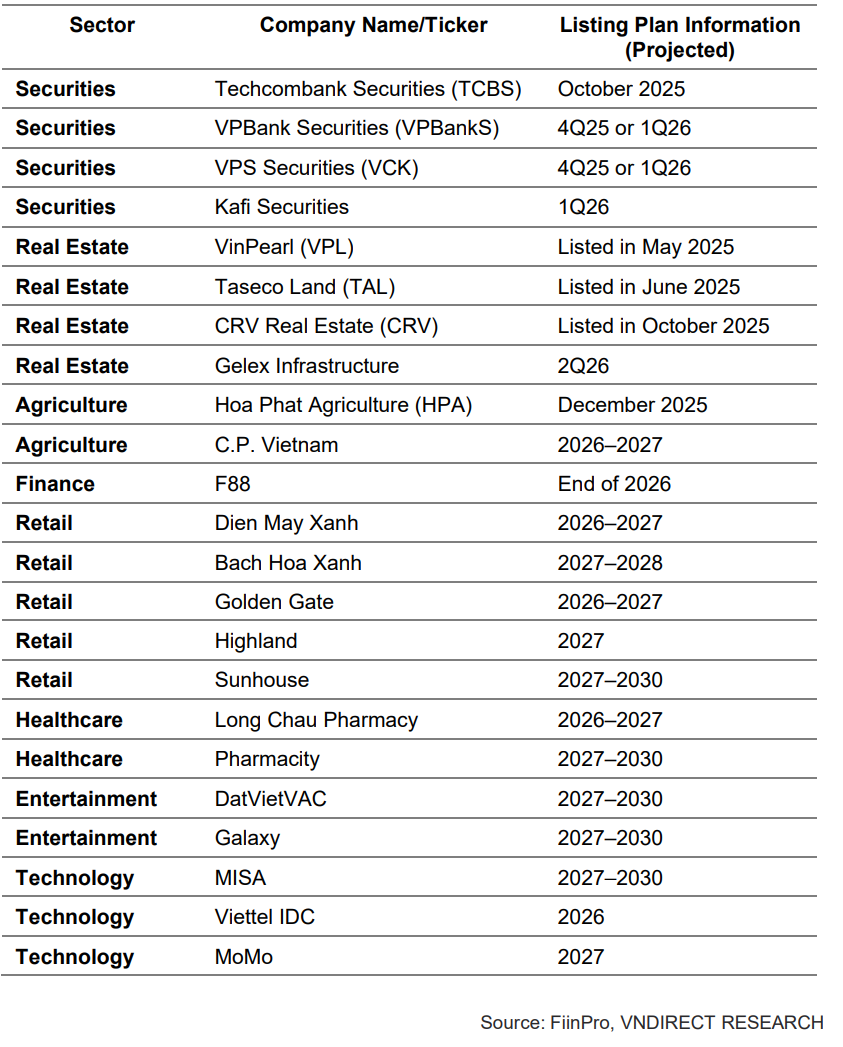

After a prolonged period of subdued activity, IPO operations are poised for a robust resurgence this year, heralding a new IPO cycle characterised by a high-calibre pipeline of transactions distributed across diverse sectors, including the retail sector (Highland, Golden Gate); financial services (TCBS, VPBankS, VPS, F88); entertainment (DatvietVAC); technology (Misa; VNG, MoMo); and real estate (VPL, TAL, Viettel IDC).

The report points out seven principal catalysts fuelling the anticipated IPO resurgence. First is macroeconomic growth underpinned by accommodative monetary policies, both domestically and globally. Second is FTSE Russell upgrading Vietnam to secondary emerging market status. Third, refined policies engender superior pre-listing corporate governance for IPO aspirants.

Fourth, new regulations have eased constraints on foreign ownership quotas and free-float conversion ratios relative to prior frameworks. Fifth, divestment protocols for SOEs have been bolstered. Sixth, IPO administrative processes have been expedited alongside enhanced post-listing investor safeguards. Seventh, the market now has augmented technical infrastructure preparedness through the rollout of the advanced KRX trading system.

According to Vietnam Investment Review

best iptv : Welcome to Best IPTV 4K, the ultimate destination for high-quality IPTV streaming in crystal-clear 4K Ultra HD. We bring together the best of entertainment — live TV channels, sports, movies, and series from all over the world — into one simple, powerful platform that delivers the smoothest viewing experience possible.

At Best IPTV 4K, we combine premium technology with powerful servers to guarantee zero buffering, stable connections, and vibrant 4K image quality. Whether you love live sports, blockbuster films, or international channels, our IPTV service gives you instant access to everything you enjoy — anytime, anywhere.

Our IPTV system is compatible with Smart TVs, Android devices, Fire Stick, Windows PCs, Mac, tablets, and mobile phones, allowing you to stream…