top of page

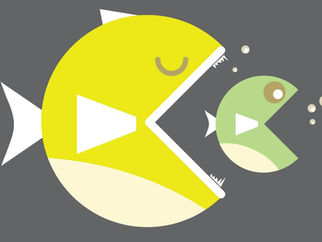

Revisiting Vietnam’s billion-dollar M&A deals in 2025: A launchpad for global expansion or the “sell-out” of local brands?

As mergers and acquisitions (M&A) activity in Vietnam has accelerated over the past decade, large-scale transactions have not only reshaped ownership structures within domestic companies but also forced many local brands to confront a strategic crossroads: preserving their original identity or pivoting toward a new growth trajectory. This context raises a fundamental question: are Vietnamese enterprises losing their identity when “selling” to major investors, or are they proa

Jan 4

List the major Vietnamese packaging companies that have been acquired by foreign entities

In fact, in the past 5 years, more than 10 of Vietnam's largest packaging enterprises have been "taken over" by "thôn tính"

Sep 28, 2023

Capital Thirst driving the real estate M&A market: insiders

Many property developers are planning asset and stock sales as they look to slash debts, restructure the business and stay afloat

Apr 26, 2023

Post-Covid-19: The reversal of Vietnamese pharmaceutical production against the M&A wave

On the other hand, local companies such as Dược Hậu Giang, Imexpharm, and Pymepharco... can also access technology, expertise, and new

Feb 14, 2023

Real estate absorbs over $4.4 billion in FDI

FDI in real estate topped $4.4 bln as of Dec 20, accounting for over 16% of the total FDI capital registered in Vietnam, and up $1.8 bln YoY

Dec 29, 2022

The fintech supports smart transactions in M&A

Nevertheless, foreign investors are exploring the untapped potential in the fintech industry to stay competitive in the digital era.

Nov 23, 2022

M&A in Vietnam sustained its strong pace with a total value of $4.97 billion in 1H

Mergers and acquisitions (M&A) in Vietnam sustained their strong pace in the first six months of 2022 with a total value of $4.97 billion.

Sep 14, 2022

M&A activity will be high during the second half of this year.

The growing demand for sustainable investment options and lower valuations will keep M&A activity high during the second half of this year.

Aug 30, 2022

1/12

bottom of page